Contents:

Clear testing of the upper trendline of the ascending triangle shows multiple tops have formed, enticing traders to sell or short. Returning to one of the bull flags on Tesla’s chart, we can see how to approach an entry on the bull flag. #2 represents the first candlestick to close outside of the flag and is an entry the aggressive trader would consider taking. The ascending triangle forms when there is a flat top with an upward sloping trendline. For traders who are short and attempting to short inside an ascending triangle, this is a very, very painful pattern.

Metabest candlestick patterns for day tradingr – This platform is ideal if you are looking for forex daily charts. Investing with MT4 and MT5 offer in-depth and easy-to-navigate charting solutions. Every minute, a new price bar will form, showing you the price movements for that minute. Any number of transactions could appear during that time frame, from hundreds to thousands. Online you will see a lot of day trading 1, 5, 15 and 30-minute charts. All charts have a time frame, usually on the x-axis, which will determine the amount of information they display.

Daytrading.com may receive compensation from the brands or services mentioned on this website. A good one is the one we have labelled a bullish engulfing. We Introduce a new Bank Nifty Future strategy for Intraday.Gave a 90% return in the last 6 months.Please check the link below for more information. The first candle is a long bullish candle which is followed by a small candle which ideally should be a Doji candle.

Plan your trading

For example, you will see in a moment the 8 bearish candlestick patterns that we describe below. Each one provides a trigger for your entry and allows you to set your maximum risk above the pattern. The evening and morning star candlestick patterns occur at the end of upwards/downward trends respectively and tend to indicate reversal patterns.

In order to find enough demand to push through that resistance, the stock may need to consolidate lower until enough shares are accumulated. Essentially, the broader context of candles will paint the whole picture. I will do a video on the DOM when I start creating videos for our Youtube channel. I dearly appreciate your trading insights, my interest is in using the DOM within order flow to make a trading decision. Start by focusing on the two or three patterns that make the most logical sense to you.

Little To No Price Retracement

The most common chart patterns are shapes such as rectangles and triangles. The second candle completely ‘engulfs’ the real body of the first one, without regard to the length of the tail shadows. The Bullish Engulfing pattern appears in a downtrend and is a combination of one dark candle followed by a larger hollow candle. This is followed by considerable selling pressure, which wasn’t enough to bring the price down below its opening value.

12 Bearish Candlestick Patterns for Stock Trading • Benzinga – Benzinga

12 Bearish Candlestick Patterns for Stock Trading • Benzinga.

Posted: Thu, 09 Feb 2023 08:00:00 GMT [source]

NinjaTrader is one of the best charting solutions in 2023. You may monitor the market and see how price reacts at various zones or even view the impact of historical events on price. It all depends on what you want to do at that point in time. Backtesting is also an excellent way to use charts and indicators. When you want to get a reasonable hypothesis for a strategy, you can backtest the strategy on a demo account to know its success rate and how it typically plays out.

Concealing Baby Swallow candlestick pattern

Three outside up/down are patterns of three candlesticks on indicator charts that often signal a reversal in trend. Ladder bottom/top are reversal patterns composed of five candlesticks that may also act as continuation patterns. The body of the candle is short with a longer lower shadow. This is a sign of sellers driving prices lower during the trading session, only to be followed by strong buying pressure to end the session on a higher close. The Hammeris a bullish reversal pattern, which signals that a stock is nearing the bottom in a downtrend.

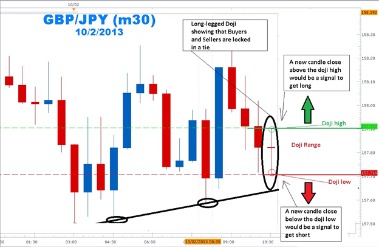

The market fluctuates within a specific range for a prolonged time. Neither of the two gets more beneficial due to the choppiness of the market. This system was first interpreted in Japan and as “The Candlestick trading bible” which is one of the most powerful trading systems in history. It was invented by Homma Munehis, The father of the candlestick chart pattern. A doji is a candlestick formation where the open and close are identical, or nearly so. A spinning top is very similar to a doji, but with a very small body, in which the open and close are nearly identical.

Four continuation candlestick patterns

Some of the best day trading profits occur from successfully trading as one trend exhausts itself and another begins. Candlestick patterns are not necessarily any more accurate than other approaches but they tend to be easier to spot. It is important to put what one learns from a single candlestick signal in context. For example, the hammer signal is useful in deciding when a downward trend is getting ready to reverse.

This gives the attentive trader an opportunity to capitalize by going short. The stock then reclaims vwap, its downward trajectory, and the bulls submit to the bears one more time. This gives us the confidence to go short, risking toward the highs.

You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. No representation or warranty is given as to the accuracy or completeness of the above information.

When looking at a candle, it’s best viewed as a contest between buyers and sellers. A light candle means the buyers have won the day, while a dark candle means the sellers have dominated. But what happens between the open and the close, and the battle between buyers and sellers, is what makes candlesticks so attractive as a charting tool. Traditionally, candlesticks are best used on a daily basis, the idea being that each candle captures a full day’s worth of news, data, and price action. This suggests that candles are more useful to longer-term or swing traders.

- It is no match for the supply in the first 5-minute candle of the day.

- You, and you only, have the power to make any investment decision.

- Traders interpret this pattern as the start of a bearish downtrend, as the sellers have overtaken the buyers during three successive trading days.

- These candlestick patterns are most reliable and lethal around support and resistance zones.

- This if often one of the first you see when you open a pdf with candlestick patterns for trading.

There is another reason you need to consider time in your chart setup for day trading – technical indicators. You may find lagging indicators work the best with less volatility, such as moving averages. You might then benefit from a longer period moving average on your daily chart than if you used the same setup on a 1-minute chart. One of the most popular types of intraday trading charts is line charts. You still opt for a time frame, but the chart will only display the closing prices for that period, say 5 minutes. Each closing price will be connected to the next closing price with a continuous line.

This suggests that, in the case of an uptrend, the buyers had a brief attempt higher but finished the day well below the close of the prior candle. This suggests that the uptrend is stalling and has begun to reverse lower. Also, note the prior two days’ candles, which showed a double top, or a tweezers top, itself a reversal pattern. We hope you’ll find this lesson a beneficial tool in your short-trading-strategy belt. Nothing beats the ability to read charts well and bearish candlestick patterns are an integral part to that process.

You cannot profitably trade with candlestick-based patterns and indicators without knowing first what a longer shadow or smaller body means. When you look at the EUR/JPY pair shown below, there are several candlestick patterns that you can see. Finally, you can use an automated method to find candlestick patterns. Second, if you are new to these candlestick patterns, a simple way is to use a candlestick cheat sheet that lists all of them. The third candle is a long bearish candle that signals the end of the bull move.

This https://g-markets.net/ will briefly touch upon what candlestick patterns are and introduce the top 10 formations all traders should know to trade the markets with ease. Japanese candlesticks were the first use of technical analysis in predicting price movement. The basis of technical analysis is that the market already knows all of the fundamental information needed to make decisions. Technical indicators tell you how market sentiment is responding to that information. RSI, volume, plus support and resistance levels all aide your technical analysis when you’re trading. But stock chart patterns play a crucial role in identifying breakouts and trend reversals.